How To Claim Exemptions From Long Term Capital Gains - TOP CHARTERED ACCOUNTANT IN AHMEDABAD,GUJARAT,INDIA|TAX FILING|INCOME TAX|GST REGISTRATION|COMPANY FORMATION|AUDIT SERVICES|ACCOUNTING|TAX CONSULTANCY|BEST CA IN AHMEDABAD

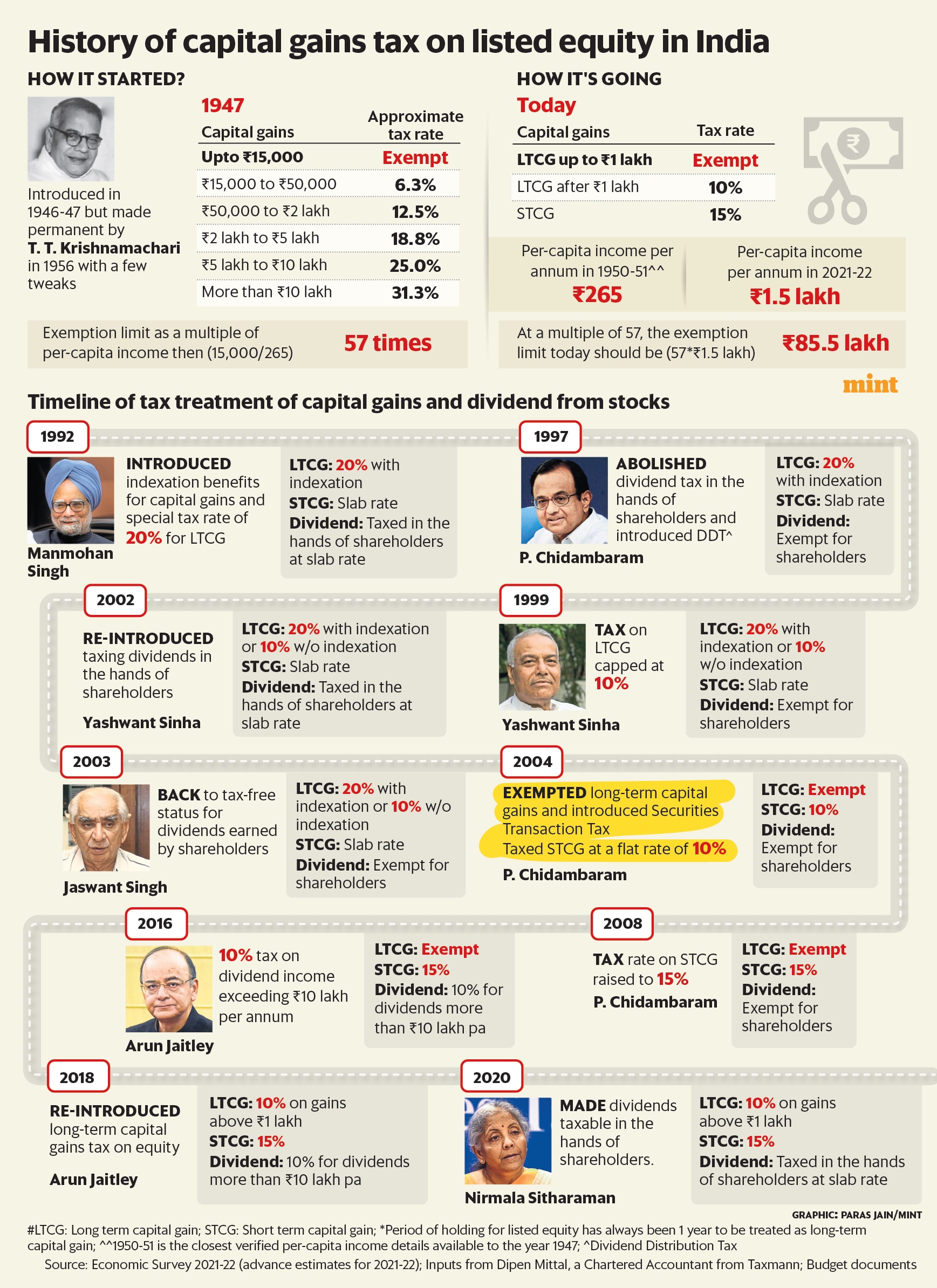

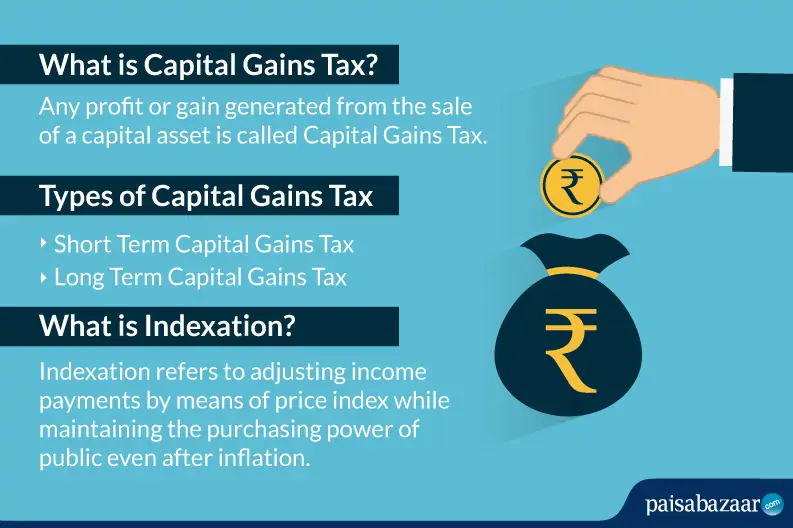

Capital gains are the profits you make from selling your investments, and they can be taxed at lower rates | Business Insider India